maryland digital ad tax effective date

Persons with global annual gross revenues equal to or greater than 100000000 must pay a tax on the portion of those revenues derived from digital advertising services in the state of. 732 2020 the Maryland Senate on February 12 2021.

Maryland Digital Advertising Tax Litigation Focus Moves To State Courts

The Maryland Comptroller recently issued final regulations interpreting the Maryland digital advertising services tax.

. However because the legislation is applicable to all taxable years beginning after. Maryland enacts tax on digital advertising services Tax Alert Overview On February 12 2021 the Maryland Senate following the House of Delegates. Effective March 14 2021 the Maryland sales and use tax applies to the sale or use of a digital product or a digital code.

The tax is applicable to all taxable years beginning after December 31 2020. Marylands first-in-the-nation gross revenue tax on digital advertising took effect on March 14. Based on todays veto override the bill should become effective on or about March 14 2021.

The statutory references contained in this publication are not. 1 This tax which is intended to be imposed on the. As mandated by the Maryland Constitution the tax will take effect in 30 days.

A constitutional challenge to Marylands digital ad tax by Comcast and Verizon will advance after a state court judge largely denied the states motion to dismiss the case. The state Senate Monday overwhelmingly passed SB. Maryland Digital Advertising Services TaxImplementation Delay Likely Tuesday March 2 2021 On the morning of Friday February 26 2021 the Maryland Senate Budget and.

On April 12 2021 Maryland legislators passed Senate Bill 787 which proposed several significant amendments to Marylands digital ad tax. 12 The first measurement period for the tax was moved from 2021 to 2022. The tax applies to annual gross revenue derived from digital advertising in the state and is.

February 16 2021 2021-5196 United States. Maryland enacts new taxes on digital advertising and sales of digital goods On 12 February 2021 the Maryland legislature overrode Maryland. The first estimated quarterly.

Effective date in the previously vetoed. In May 2021 Maryland enacted legislation to delay the effective date of the digital advertising tax. Currently as scheduled taxpayers subject to the digital advertising tax must file a declaration of estimated tax on or before April 15 2022 and make quarterly estimated.

Most notably Senate Bill 787. 787 which delays and modifies the Digital Advertising Gross Revenues Taxa tax of up to 10 on the gross revenue. Maryland Breaks Ground with Digital Advertising Tax Wednesday March 17 2021 Overriding the governors veto of HB.

Personal Property Tax Howard County

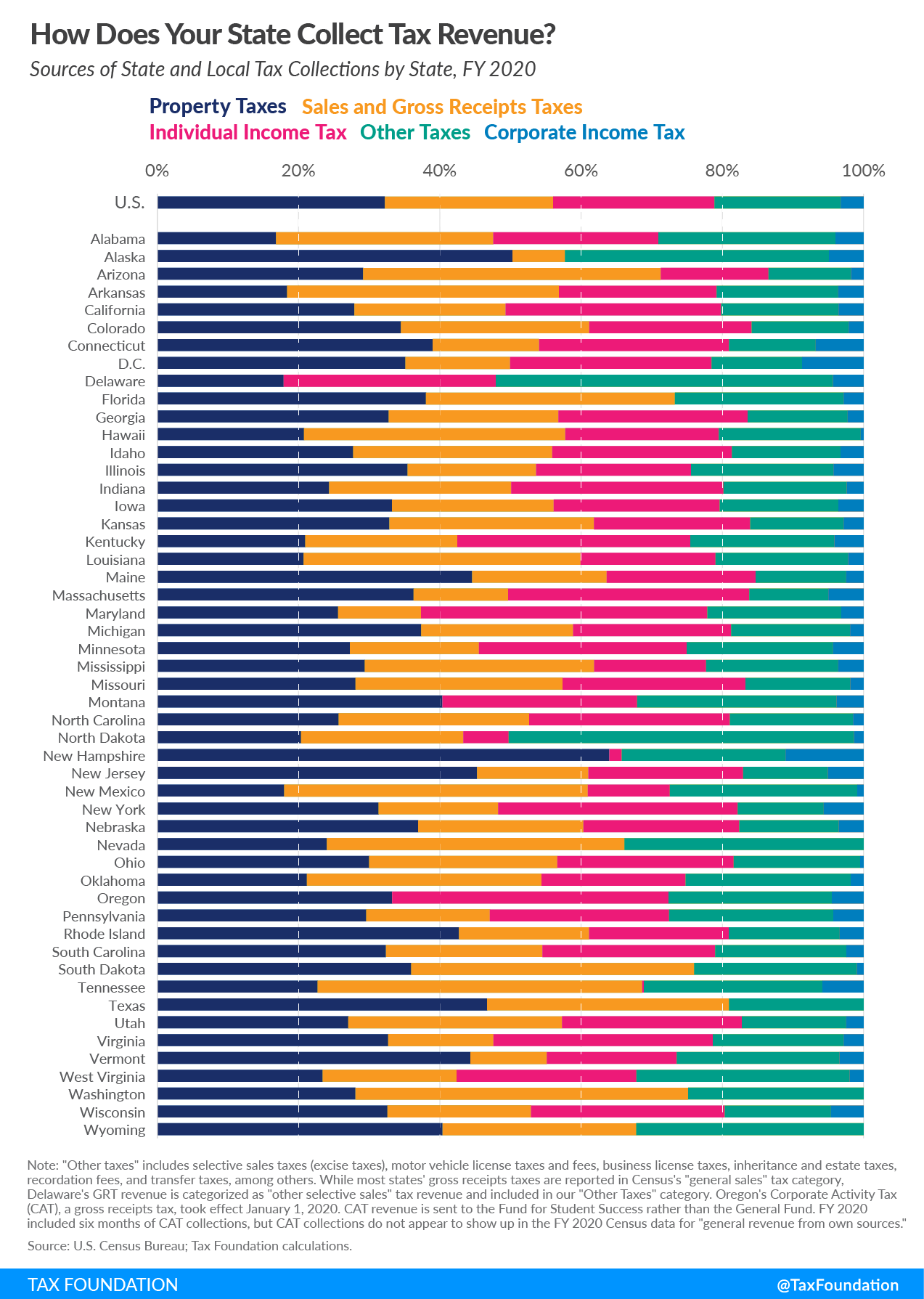

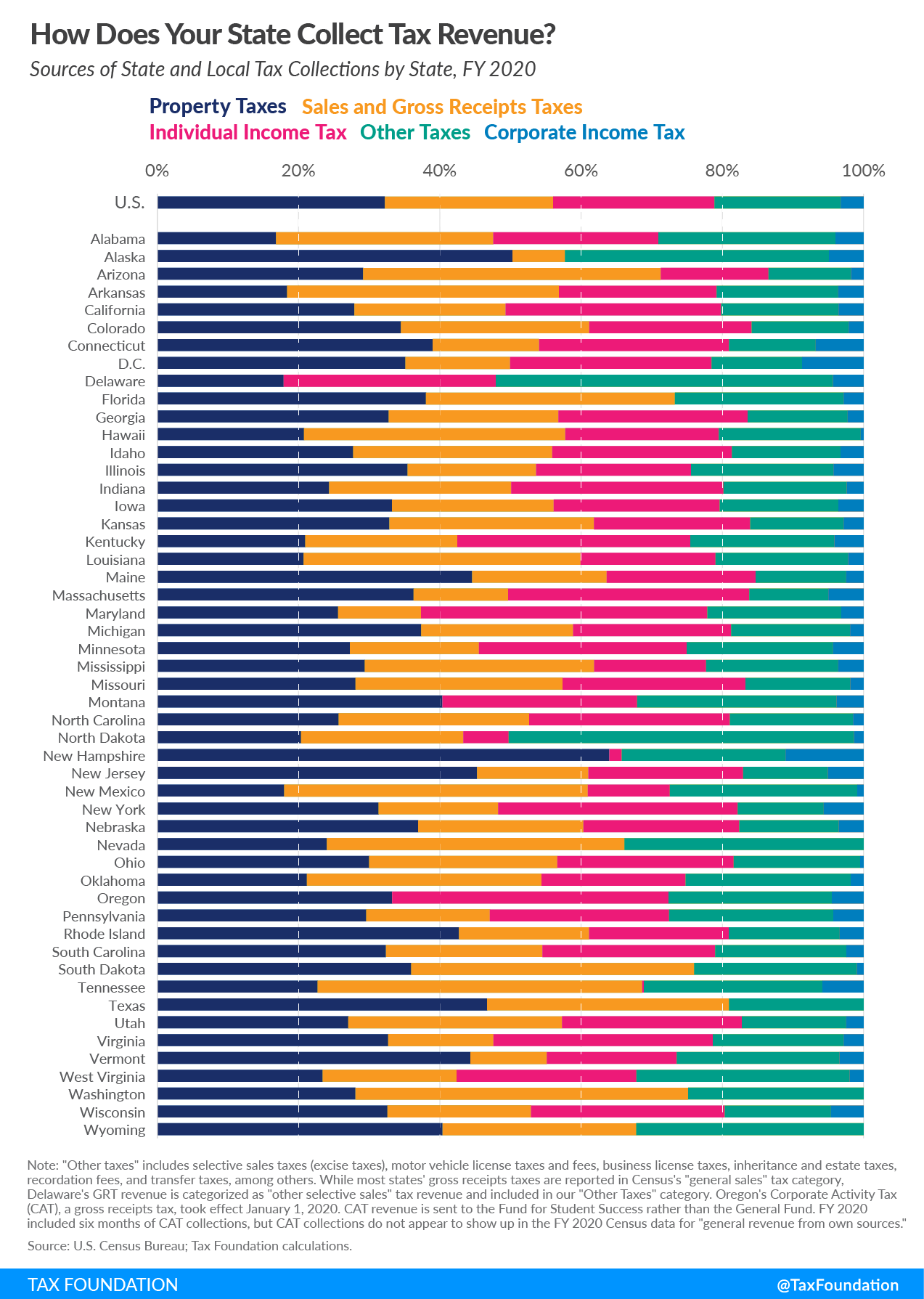

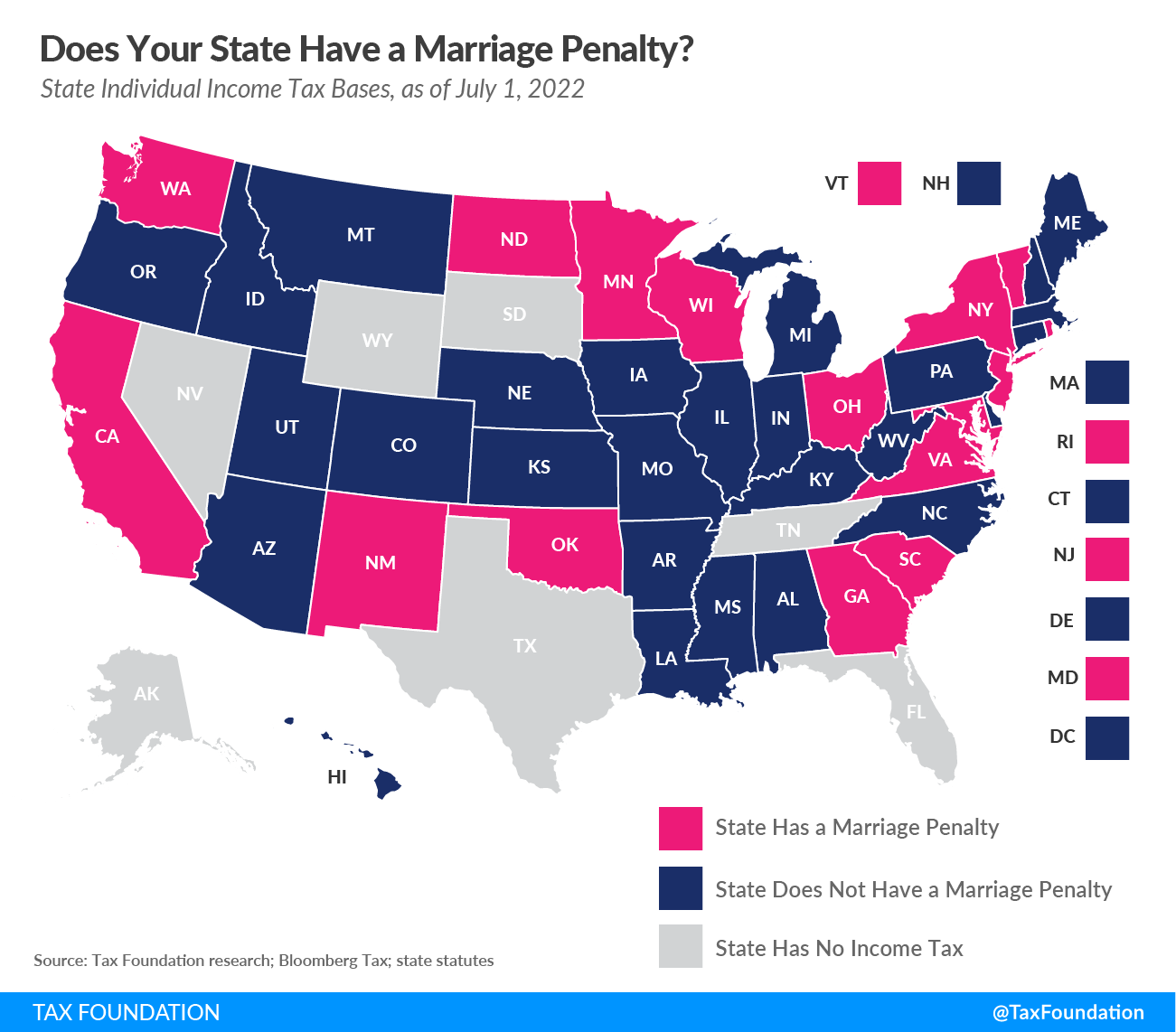

Maryland Tax Rates Rankings Maryland State Taxes Tax Foundation

Maryland Tax Rates Rankings Maryland State Taxes Tax Foundation

Maryland Tax Rates Rankings Maryland State Taxes Tax Foundation

Maryland Sales Use Tax Guide Avalara

Marylandreporter Com The News Site For Government And Politics In The Free State

Pin On Know How Business Trends Tips Of The Creative Economy Aka Creative Industries

Maryland Tax Rates Rankings Maryland State Taxes Tax Foundation

Downtown Baltimore Map Print Maryland Md Usa Map Art Poster City Street Road Map Wall Decor Office Gifts Women Gift For A Judge Nm179

Maryland Enacts Digital Products Sales Tax Exclusions Pwc

States With The Lowest Corporate Income Tax Rates Infographic Infographic History Geography Best Places To Move

Maryland Tax Rates Rankings Maryland State Taxes Tax Foundation

Maryland Suspends Gas Tax To Offset Inflation At The Pump Kiplinger

Maryland Tax Rates Rankings Maryland State Taxes Tax Foundation

Wedding Photography Contract Template Wedding Photography Contract Template Wedding Photography Contract Photography Contract

Maryland Tax Rates Rankings Maryland State Taxes Tax Foundation

Maryland Refundwhere S My Refund Maryland H R Block

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation